Federal Identification Number Vs Tin

Income Tax Return for Estates and Trusts. Yes the payers tax identification number is the same as the federal identification number.

Taxpayer Identification Number Tin

TIN nummer Amerika het SSN Een SSN Social Security Number is nodig om aangifte te doen in de Verenigde Staten.

Federal identification number vs tin. Employer Identification Number EIN. Is the Federal ID number the same as the Payers TIN. It stands for Taxpayer Identification Number and it is basically the same thing as an EIN.

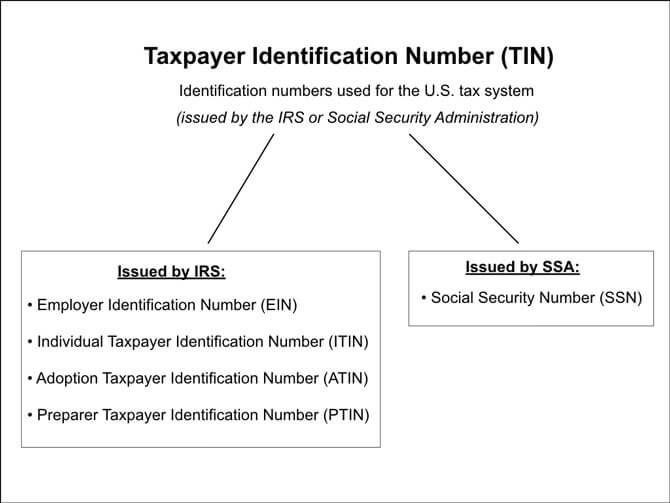

There are three different types of numbers the IRS uses for tax purposes. As opposed to a TIN an EIN can be obtained right away and free-of-cost after verification. This is a tax ID for individuals.

Social Security Number SSN individual taxpayer identification number ITIN and an employer identification number EIN. An Employer Identification Number EIN is also known as a federal tax identification number and is used to identify a business entity. It is also used by estates and trusts which have income which is required to be reported on Form 1041 US.

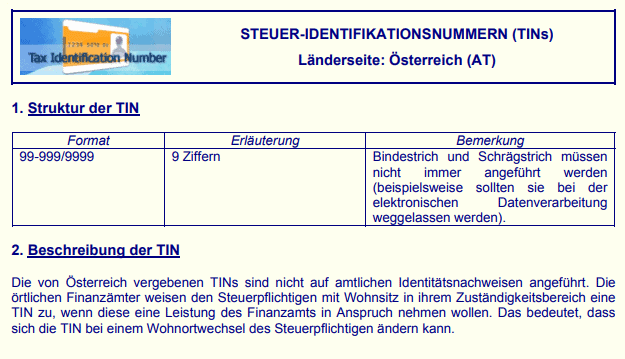

The good news is that a FEIN Federal Employment Identification Number an EIN Employment Identification Number are very similar and both are TINs Tax Identification Numbers issued by the IRS. TINs are also useful for identifying taxpayers who invest in other EU countries and are more reliable than other identifiers such as name and address. Sinds recent vragen banken in uw land ook naar dit nummer.

It stands for Individual Taxpayer Identification Number and is a nine-digit number used to identify an individuals for tax purposes. Taxpayer Identification Number TIN and Employer Identification Number EIN are defined as a nine-digit number that the IRS assigns to organizations. See the form used to apply manually for a tax ID number.

An EIN also known as a Federal Tax Identification Number is issued to business entities by the IRS. This 9 digit number is used by the IRS to determine. XX-XXXXXXXXX to business entities operating in the United States for the purposes of identification and employment.

A Taxpayer Identification Number is often abbreviated to TIN and is used by the Internal Revenue Service IRS to identify individuals efficiently. Where you get your TIN how it is structured and whether a TIN is the right form of identification for your purposes sometimes seems like it isnt as straightforward as it should be. Learn where to go an.

TINEIN are used by employers sole proprietors corporations partnerships nonprofit. Have you ever wondered what the difference is between a Social Security Number SSN and an individual Taxpayer Identification Number TIN and how it is us. In the United States it is also known as a Tax Identification Number or Federal Taxpayer Identification Number.

Usually TINs are assigned to businesses that have employees. If youre wondering about the differences between a TIN and an EIN SSNs and ITINs are tax IDs for individuals while EINs are used for businesses. To get an EIN you must first check with your state guidelines.

Refer to Employer ID Numbers for more information. An EIN more specifically is a type of TIN assigned to business entities only not to individuals. Most EU countries use Tax Identification Numbers TINs to identify taxpayers and facilitate the administration of their national tax affairs.

The IRS uses the number to identify taxpayers who are required to file various business tax returns. This is also referred to as a federal tax identification number or federal employer identification number EINs identify business entities like. TIN nummer Amerika het SSN.

Learn how to get a federal taxpayer identification number FTIN TIN EIN. Also known as a federal tax identification number it is used to identify your business as a single entity in the eyes of the federal government in all tax-related matters. The Employer Identification Number EIN also known as the Federal Employer Identification Number FEIN or the Federal Tax Identification Number FTIN is a unique nine-digit number assigned by the Internal Revenue Service IRS format.

A Taxpayer Identification Number TIN is an identifying number used for tax purposes in the United States and in other countries under the Common Reporting Standard. Zij vragen dan naar uw TIN Tax Identification Number maar dit is dus in het geval van een Amerikaan een SSN.

A Detailed Guide To Get Your Tax Identification Number In 5 Days Smart Entrepreneur Blog

Tin Ssn Ein And Itin Taxpayer Id Numbers Llc University

Tax Identification Number Tin Number Tin Number Loan Company Paying Taxes

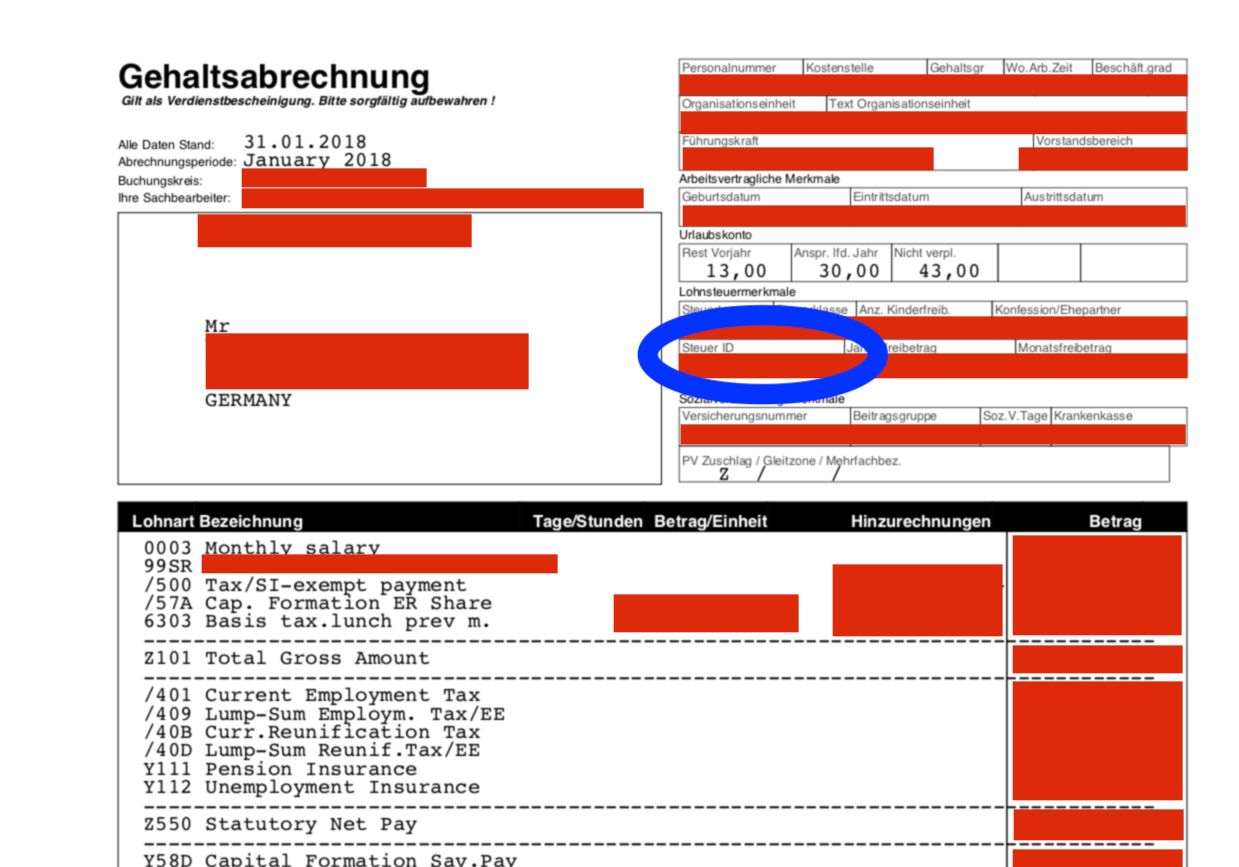

Tin Steuernummer Wo Finde Ich Die Tin Broker Vergleich Tests Erfahrungen

1099 R Software To Create Print And E File Irs Form 1099 R Irs Irs Forms W2 Forms

How To Find Your German Tax Id Steuer Id Steuernummer And Vat Number All About Berlin

The Difference Between Tax Id Tin And Tax Number In Germany

What Is Tin Tax Identification Number In Uae Audit Services Tax Vat In Uae

Fake Bank Statement 2 2 Unconventional Knowledge About Fake Bank Statement 2 That You Can T Confirmation Letter Doctors Note Template Letter Of Employment

Https Www Oecd Org Tax Automatic Exchange Crs Implementation And Assistance Tax Identification Numbers Iom Tin Pdf

Ohio I File Taxpayer Identification Number

How To Find Your German Tax Id Steuer Id Steuernummer And Vat Number All About Berlin

Steueridentifikationsnummer Vs Steuernummer Which Tax Numbers Do I Need In Germany Nomaden Berlin

Tin Steuernummer Wo Finde Ich Die Tin Broker Vergleich Tests Erfahrungen

How To Find Your German Tax Id Steuer Id Steuernummer And Vat Number All About Berlin

If You Are Interested In Starting A Business Make Sure You Visit The Small Business Blog We Cover Topics Business Checklist Small Business Start Up Business

What Is Tax Identification Number Tin For Us And Foreign Persons

Post a Comment for "Federal Identification Number Vs Tin"