How To Inform Irs Of Identity Theft

IRS Form 14039 Identity Theft Affidavit will inform the IRS that you have been a victim of identity theft. You should also contact the Internal Revenue Service.

Https Www Irs Gov Pub Irs Utl Oc Protectingyouandyourtaxrefundisatoppriorityfortheirs Pdf

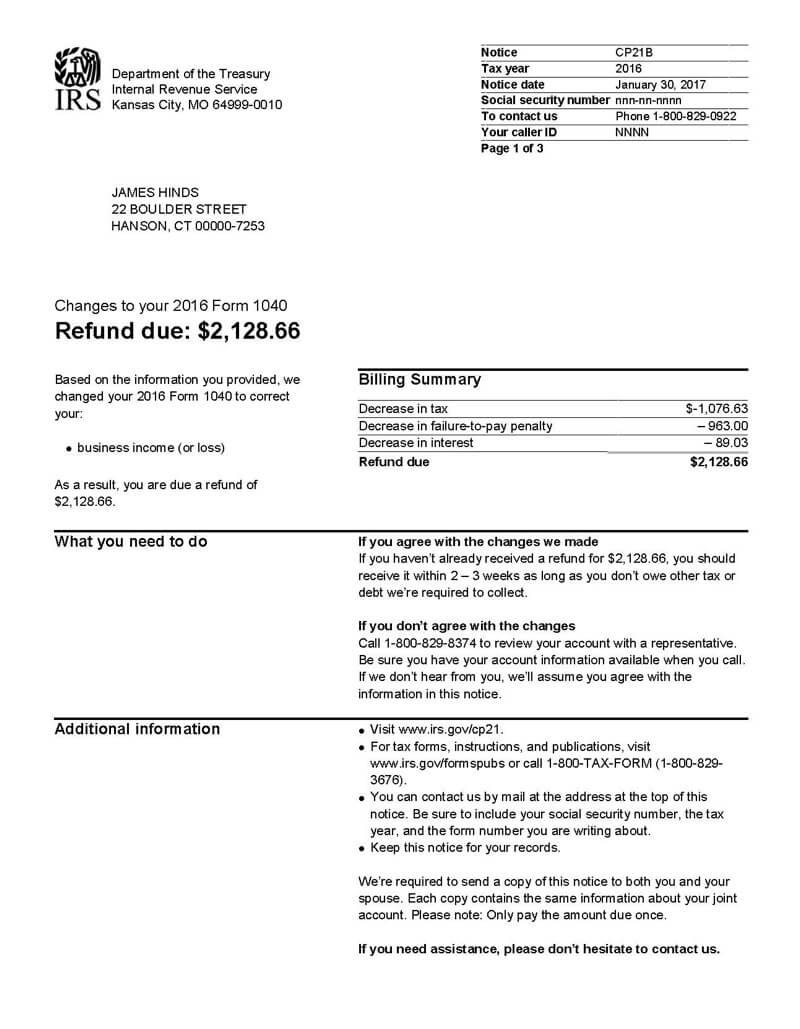

You get a letter from the IRS inquiring about a suspicious tax return that you did not file.

How to inform irs of identity theft. This is a unique number containing six digits which has to be used in order to e-file a tax return. More information to help you guard against identity theft is available at IRSgov enter ID Theft. If you have been the victim of identity theft the IRS is able to issue you with an IP PIN.

In order to verify the identity of the taxpayer they will send a letter asking whether you sent a tax return which bears your name and Social Security number. File your tax return and form 14039 together. Call the IRS on the number provided on the notice.

Identity theft has become common enough that the IRS has a specific form to filethe IRS Identity Theft Affidavit for notifying them that you believe you are a victim of identity theft. IRS launches new website to help inform consumers about identity theft Uncategorized. Complete IRS Form 14039 Identity Theft Affidavit.

Use a fillable form at IRSgov print then mail or fax according to instructions. Why You Should Notify the IRS About Your Loved Ones Death. Part 3 of 3.

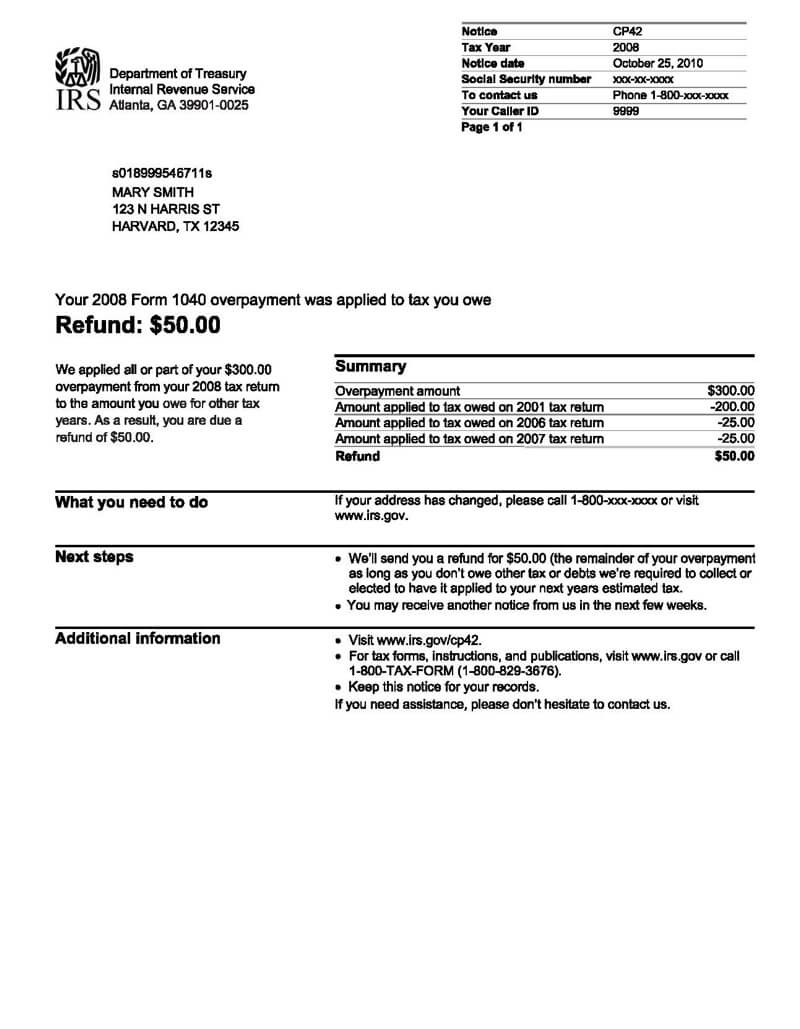

First the IRS will acknowledge your reported tax identity theft. Those victims of IRS identity theft who detect the problem after having their tax refund submission rejected should take the following steps. If youre an actual or potential victim of identity theft and would like the IRS to mark your account to identify any questionable activity please complete Form 14039 Identity Theft Affidavit PDF.

Avoid putting too much information in an obituary such as birth date address mothers maiden name or other personally identifying information that could be useful to identity thieves. Complete the IRS identity theft form. The form may be filled out online then printed and mailed or faxed.

The IRS state tax agencies and private industry partner to detect prevent and deter tax-related identity theft and fraud. Complete form IRS Form 14039 Identity Theft Affidavit. Treat your identity like cash and dont leave it lying around the agency says.

You get a tax transcript in the mail that you did not request. If you discover another tax return has been filed with your information use IRS Form 14039 an identity theft affidavit to alert the IRS. Form 14039 or the Identity Theft Affidavit let the IRS know of this issue and prompts an investigation to resolve the tax issue.

Taking Other Action Download Article 1. Information for submitting the form is on page two of Form 14039 depending on how it was printed it this may be on the back of the form. Call the number provided.

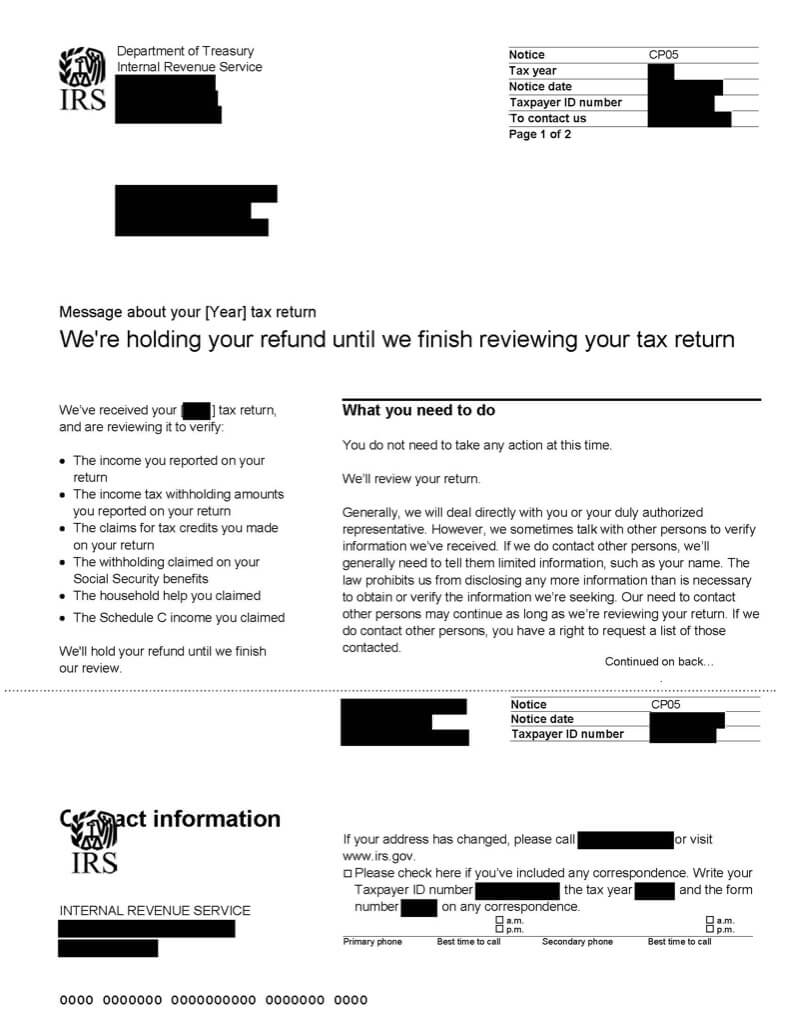

You cant e-file your tax return because of a duplicate Social Security number. If you get a letter from the IRS inquiring about a suspicious tax return that. See the Instructions for Submitting this Form in Form 14039 for information on submitting it.

Identity theft is not one single type of crime. There are many different ways a criminal can use your information such as applying for government benefits getting a job under your Social Security number receiving medical care or prescription drugs in your name and of course the financial aspects. The IRS will send you a notice.

Another warning sign of IRS identity theft is receiving income information from an. If your SSN has been compromised and you know or suspect you may be a victim of tax-related identity theft take these additional steps. During this time the IRS may ask you to prove your identity typically with letter 5071C.

This will alert the IRS and prevent them from paying the identity. Respond immediately to any IRS notice. 3 You receive income information from an unknown employer.

Form 14039 is how a taxpayer can inform the IRS of a fraudulent tax return filed with their SSN. The IRS doesnt initiate contact with taxpayers by email text messages or social media channels to request personal or financial information. The IRS reports that typical identity theft cases take around 120 days to fully resolve.

The Internal Revenue Service IRS has launched Identity Theft Central giving consumers beefed-up access to advice on protecting themselves against identity theft phishing. Look for signs of identity theft soon after your loved one. If you are unable to e-file because a fraudulent return makes yours appear as a duplicate you should file your tax return by paper instead.

Be alert to possible tax-related identity theft if. Review your credit report. Protect the assets of your loved ones estate by not allowing thieves to open new accounts under your loved ones Social Security number.

Nonetheless there are some simple things to be on the lookout for that signal possible tax-related identity theft. Identity theft is a real problem in the United States and one of the primary victims of this form of theft is deceased individuals. By Gary Guthrie of ConsumerAffairs.

If you receive this letter it is likely someone filed a return in your name without your knowledge. Phishing and Online Scams. Within 30 days after the IRS gets your Form 14039 youll get a letter telling you that the IRS received your affidavit.

Publication 970 2018 Tax Benefits For Education Internal Revenue Service Internal Revenue Service Education College Loans

Identity Theft Affidavit Irs Form 14039 Lupe Ruiz

Irs Form 14039 Guide To The Identity Theft Affidavit Form

Https Www Irs Gov Pub Irs Utl Oc Protect Yourself From Identity Theft Final Pdf

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

Http Www Irs Gov Pub Irs Utl Oc Protectingyouandyourtaxrefundisatoppriorityfortheirs Pdf

Evite Hit With Data Breach Sc Media Data Breach Data Accounting

This Is A Great Starting Place To Inform Yourself About Identity Theft How To Prevent It What To Do If It Happe Identity Theft Online Signs Remember Password

3 Ways To Write A Letter To The Irs Wikihow

Irs Notice Audit Letter 3572 Understanding Irs Audit Letter 3572

Tax Season 2018 Blog Series 3 10 5 Tips To Help You Stay Safe During Tax Season Tax Season Tax Refund Tax

Stimulus Check 2021 Irs Says Letter From White House Outlining Stimulus Payments Not A Scam Abc7 Chicago

Irs Tax Notices Explained Landmark Tax Group

Post a Comment for "How To Inform Irs Of Identity Theft"